A Stark Divide: The Wealth Gap Between Black Americans and Others

The wealth gap between Black Americans and other groups in the United States is a significant and persistent issue. While the gap has narrowed somewhat in recent decades, it remains vast and deeply rooted in historical injustices and ongoing systemic inequalities.

Key Numbers:

- Median wealth: Black households hold a median wealth of only $24,100, compared to $188,200 for white households. This represents a staggering 7.8 times difference.

- Average wealth: The average wealth disparity is even greater, with white households holding an average of $983,400 compared to $142,500 for Black households, a 6.9 times difference.

- Disparities across age groups: The wealth gap persists across all age groups, with Black Americans disadvantaged at every stage of life.

Causes of the Wealth Gap:

- Historical discrimination: Centuries of slavery, Jim Crow laws, discriminatory lending practices, and other forms of systemic racism have limited Black Americans’ access to wealth-building opportunities like homeownership and inheritance.

- Wage disparities: Black Americans face significant wage gaps compared to white Americans, earning less over their lifetimes and accumulating less wealth.

- Limited access to financial resources: Black communities often have limited access to affordable financial services, investment opportunities, and financial education, further hindering wealth creation.

Consequences of the Wealth Gap:

- Limited economic mobility: The wealth gap restricts Black Americans’ ability to move up the economic ladder, hindering their access to better education, healthcare, and housing.

- Increased vulnerability: The lack of wealth leaves Black Americans more vulnerable to economic shocks and financial instability.

- Intergenerational poverty: The wealth gap can be passed down through generations, perpetuating poverty and inequality.

Bridging the Gap:

Closing the wealth gap requires comprehensive solutions that address historical injustices and create a more equitable economic landscape. This includes:

- Policy solutions: Eliminating discriminatory practices, promoting equal pay for equal work, and increasing access to affordable housing and education.

- Community development: Investing in Black communities to create jobs, expand access to financial resources, and foster economic growth.

- Individual empowerment: Providing financial education and resources to help Black Americans build wealth and navigate the financial system.

Bridging the wealth gap is a long-term challenge, but it is achievable through sustained commitment and collective action. By addressing historical injustices, creating a more equitable economic system, and empowering Black communities to build wealth, we can create a future where all Americans have the opportunity to thrive.

The Wealth Gap: A Challenge We Can Overcome

While the wealth gap between Black Americans and other groups is significant and rooted in historical injustices, it is not insurmountable. Through collective action, commitment to change, and individual empowerment, we can build a more equitable future where all Americans have the opportunity to build wealth and achieve financial security.

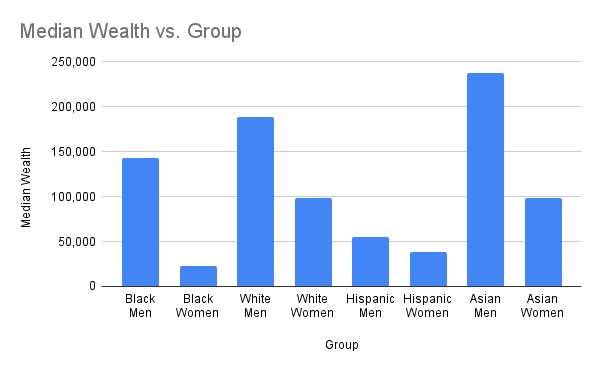

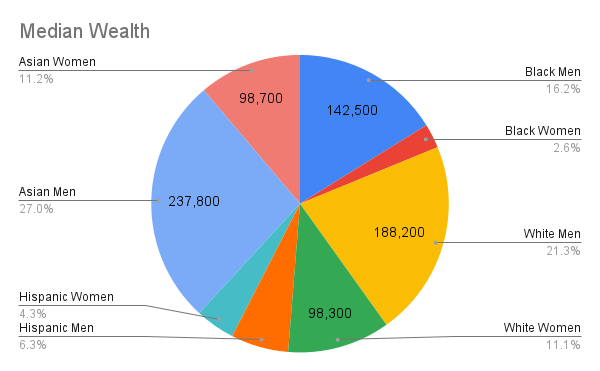

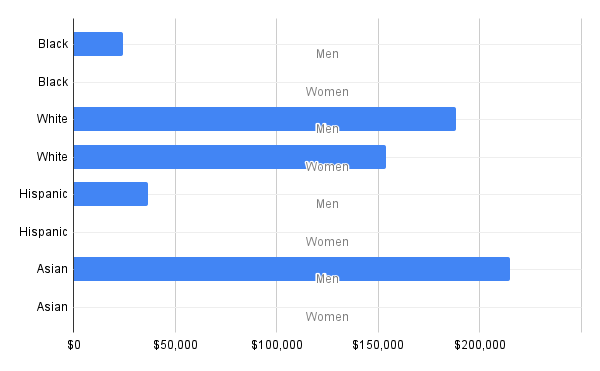

The data clearly shows significant wealth disparities across different racial and ethnic groups in the United States. White men hold the highest median wealth at $188,200, followed by Asian men at $237,800. Black women hold the lowest median wealth at $23,300, followed by Black men at $142,500. These disparities highlight the persistent issue of racial and ethnic wealth gaps in the United States. 2. Gender Wealth Gap: The data also indicates a gender wealth gap within each racial and ethnic group. White men hold significantly more wealth than white women ($188,200 vs. $98,300). The same pattern holds true for Black and Hispanic groups. This gender wealth gap is likely influenced by factors such as the wage gap and differences in career choices.

Here’s why we can be optimistic:

- Progress is being made: While the gap remains wide, it has narrowed in recent years. This demonstrates that change is possible with sustained effort.

- Growing awareness and commitment: There is a growing awareness of the wealth gap and a growing commitment to addressing it. This is evident in the increasing number of policies, programs, and initiatives aimed at promoting economic equity.

- Resilience and innovation: Black communities are known for their resilience and ingenuity. These qualities will be crucial in overcoming the challenges posed by the wealth gap.

- Individual agency: Black Americans are not passive victims of their circumstances. By taking control of their finances, making informed decisions, and accessing available resources, individuals can create a better future for themselves and their families.

Here’s what we can do to bridge the gap:

- Support policies that promote economic justice: Advocate for policies that address racial discrimination, ensure equal pay for equal work, and expand access to affordable housing, education, and healthcare.

- Invest in Black communities: Support organizations and initiatives that provide financial literacy programs, access to capital, and other resources to help Black businesses and individuals thrive.

- Seek knowledge and empower yourself: Take advantage of financial education resources, learn about investment strategies, and build your financial literacy to make informed decisions about your money.

- Connect and build community: Join support groups, network with other Black professionals, and share knowledge and resources to create a collective movement for economic empowerment.

By working together and channeling our collective energy, we can overcome the wealth gap and build a future where everyone has a fair chance to create a secure and prosperous life. Remember, the journey towards economic equity is a marathon, not a sprint. But with each step we take, we move closer to a brighter tomorrow for all.

Empowering Black Men: Building a Secure Future

The economic landscape for Black men presents unique challenges, often rooted in historical and systemic barriers. However, by focusing on key areas of empowerment, significant progress can be made towards building a more secure and prosperous future for Black men and their communities.

A. Financial Literacy:

Equipping Black men with financial literacy empowers them to make informed financial decisions, manage their money effectively, and build wealth for the future. Financial literacy programs can cover a range of topics, including budgeting, saving, investing, debt management, and credit building. By providing this knowledge and skills, we can empower Black men to navigate the financial system with confidence and achieve their financial goals.

B. Career Development:

Black men face significant barriers in the workforce, including occupational segregation, limited access to higher education, and discrimination. Addressing these issues requires a multi-pronged approach that includes:

- Promoting access to higher education and vocational training: This can provide Black men with the skills and credentials needed to qualify for higher-paying jobs.

- Mentorship and networking programs: Connecting Black men with successful professionals can provide guidance, support, and access to job opportunities.

- Addressing occupational segregation: Expanding opportunities for Black men in high-paying, traditionally white-dominated fields is crucial.

- Combating workplace discrimination: Enforcing anti-discrimination laws and promoting inclusive workplace practices are essential for creating a fair and equitable work environment.

C. Entrepreneurship:

Entrepreneurship can be a powerful tool for wealth creation and economic advancement for Black men. Supporting Black-owned businesses through resources, mentorship, and access to capital is crucial for fostering economic growth within Black communities. Additionally, promoting entrepreneurship education and training can equip Black men with the knowledge and skills needed to start and grow successful businesses.

D. Closing the Wage Gap:

Black men face a significant wage gap compared to white men, earning less for the same work. To bridge this gap, we need to:

- Advocate for policies that promote equal pay for equal work.

- Address discriminatory practices in the workplace, such as wage suppression and unconscious bias.

- Promote transparency in workplace wages and salaries.

- Empower Black men to negotiate their salaries effectively.

By investing in these key areas of empowerment, we can create a future where Black men have the tools, resources, and opportunities to thrive economically. This will not only benefit individual Black men but also contribute to the economic prosperity of Black communities and the nation as a whole.

Empowering Black Women: Building a Brighter Future

Black women face unique challenges in achieving financial security and building wealth. However, by addressing key areas that empower them to overcome these obstacles, we can create a brighter future for Black women and their communities.

A. Access to Capital:

Black women often face significant barriers in accessing capital, including limited access to bank loans, credit cards, and venture capital funding. By providing Black women with access to affordable capital, we can empower them to start and grow businesses, invest in their education, and purchase homes—key drivers of wealth creation. This can be achieved through:

- Supporting Black-owned banks and credit unions: These institutions understand the unique needs of Black communities and are better positioned to provide them with culturally competent and affordable financial services.

- Expanding access to microloans and grants: These smaller financial resources can provide Black women with the initial funding they need to get their businesses off the ground.

- Promoting investment opportunities: Connecting Black women with angel investors and venture capitalists who are committed to supporting diverse businesses can be a game-changer.

B. Combating the Gender Pay Gap:

Black women experience the dual disadvantage of being both Black and women, leading to a significant gender pay gap. Addressing this issue requires a multifaceted approach:

- Enacting and enforcing equal pay laws: Policies that ensure equal pay for equal work are essential for closing the gender pay gap.

- Combating unconscious bias in the workplace: Training employers and employees on unconscious bias and its impact on pay decisions is crucial for creating a fairer and more equitable workplace.

- Promoting transparency in workplace salaries and wages: This allows employees to identify and address pay disparities.

- Empowering Black women to negotiate their salaries effectively: Providing training and resources on salary negotiation can help Black women advocate for their worth and achieve fair compensation.

C. Affordable Childcare:

The high cost of childcare often presents a significant barrier for Black women seeking to enter or remain in the workforce. By making childcare more affordable and accessible, we can empower Black women to participate fully in the economy:

- Investing in publicly funded childcare programs: This can provide affordable childcare options for low-income families, including Black families.

- Providing tax breaks and subsidies to childcare providers: This can help to lower the cost of childcare for parents.

- Promoting flexible work arrangements: This allows working parents to balance their work and family responsibilities more easily.

D. Financial Wellness Programs:

Black women often face unique financial challenges, such as managing debt, planning for retirement, and navigating the complexities of the financial system. Providing tailored financial wellness programs can equip them with the knowledge and skills they need to make informed financial decisions and achieve their financial goals. These programs can cover topics such as:

- Budgeting and debt management

- Investing and retirement planning

- Credit building and financial literacy

- Homeownership and wealth creation

By investing in these key areas of empowerment, we can create an environment where Black women have the resources and support they need to build financial security and achieve their full potential. This will not only benefit individual Black women but also contribute to the economic advancement of Black communities and the nation as a whole.

Community-Driven Solutions: Empowering Black Communities to Close the Wealth Gap

While individual empowerment is crucial, addressing the wealth gap also requires community-driven solutions. These initiatives help to create a supportive environment where Black communities can thrive and build wealth collectively.

A. Building Financial Institutions:

- Black-owned banks and credit unions: These institutions are essential for providing culturally competent and affordable financial services to Black communities, addressing the issue of limited access to capital.

- Community development financial institutions (CDFIs): These institutions focus on providing loans and investments to underserved communities, promoting economic development within Black neighborhoods.

- Cooperative financial institutions: These member-owned institutions give Black communities a greater voice in their financial destinies and allow them to reinvest profits back into the community.

B. Community Development Initiatives:

- Invest in local businesses: Supporting Black-owned businesses through grants, loans, and technical assistance helps create jobs, stimulate local economies, and foster wealth creation within Black communities.

- Improve access to affordable housing: Providing affordable housing options and addressing predatory lending practices are crucial for stabilizing Black communities and building wealth through homeownership.

- Develop youth economic development programs: These programs can provide financial literacy education, job training, and entrepreneurial opportunities for young people, equipping them with the tools they need to build successful futures.

C. Mentorship and Networking Programs:

- Connecting Black youth with successful professionals: Mentorship programs provide guidance, support, and role models for young people, helping them navigate the career and financial landscape.

- Building professional networks: Creating networking opportunities for Black professionals across industries can facilitate knowledge sharing, collaboration, and access to career advancement opportunities.

- Supporting women’s entrepreneurship groups: These groups provide a supportive space for Black women entrepreneurs to share resources, collaborate, and access financial and business development resources.

D. Advocacy and Policy Change:

- Lobbying for policies that promote economic justice: This includes advocating for policies like equal pay for equal work, affordable housing initiatives, and increased access to education and healthcare.

- Holding elected officials accountable: Advocating for transparency and accountability from elected officials in addressing the needs of Black communities.

- Supporting organizations working for systemic change: Contributing to organizations working to dismantle discriminatory policies and practices that perpetuate the wealth gap.

By implementing these community-driven solutions, we can create a more equitable and inclusive economy where Black communities have the resources and opportunities they need to thrive. This collective effort will not only benefit Black communities but contribute to the overall economic prosperity of our nation.

Bridging the Divide: A Call for Action

The wealth gap between Black Americans and other groups is a complex and persistent issue with significant consequences. However, it is not insurmountable. Through a multi-pronged approach that combines individual empowerment, community-driven solutions, and systemic change, we can create a future where all Americans have the opportunity to build wealth and achieve financial security.

Individual Empowerment:

Every individual has the power to make informed financial decisions, take control of their finances, and build wealth through personal effort and knowledge. By investing in financial literacy, pursuing career development opportunities, and embracing entrepreneurship, Black men and women can overcome historical and systemic barriers and build a brighter future for themselves and their families.

Community-Driven Solutions:

Creating a supportive environment for Black communities to thrive is crucial for closing the wealth gap. Supporting Black-owned businesses, investing in community development initiatives, and facilitating mentorship and networking opportunities can empower individuals and communities to reach their full potential.

Systemic Change:

Addressing the root causes of the wealth gap requires comprehensive policy changes. Advocating for policies that promote equal pay for equal work, address discriminatory practices, and expand access to education and healthcare opportunities is essential for creating a more equitable and just society.

A Call to Action:

Bridging the wealth gap requires a collective effort from individuals, communities, and policymakers. We must all be committed to:

- Educating ourselves: Educating ourselves about the wealth gap and its causes is the first step towards taking action.

- Supporting Black-owned businesses and organizations: By supporting Black-owned businesses and organizations, we can invest in the economic development of Black communities.

- Advocating for policy change: We can contact our elected officials and urge them to support policies that promote economic justice.

- Empowering ourselves and others: We can take steps to build our own financial knowledge and empower others to do the same.

By working together, we can build a future where the wealth gap is a distant memory and everyone has the opportunity to achieve financial security and success.

Additional Resources to Empower Black Americans

Bridging the wealth gap and fostering economic prosperity for Black Americans requires ongoing effort and collaboration. Here are some valuable resources that can provide further information, support, and guidance:

A. National Black Women’s Economic Development Center (NBWEDC): https://www.ncbj.org/login.aspx

NBWEDC empowers Black women to achieve economic security through advocacy, research, and strategic partnerships. They offer a range of resources including:

- Financial literacy programs: Workshops, webinars, and online resources on budgeting, saving, investing, and debt management.

- Entrepreneurship development: Training programs and resources to help Black women start and grow their businesses.

- Policy advocacy: Working to advance policies that promote economic justice for Black women and families.

B. Center for American Progress (CAP): https://www.americanprogress.org/

CAP is a progressive think tank that conducts research and analysis on a range of issues, including the wealth gap and racial economic inequality. They offer:

- Reports and publications: In-depth research and analysis on the causes and consequences of the wealth gap, as well as potential solutions.

- Policy recommendations: Proposals for policies and programs that can address racial economic disparities.

- Events and webinars: Opportunities to learn from experts and engage in discussions about economic justice issues.

C. Institute on Assets and Social Policy (IASP): https://www.idealist.org/en/nonprofit/02ee1fd3c94e472bbe5da99b877925cd-institute-on-assets-and-social-policy-waltham

IASP is a research and policy organization focused on understanding and promoting asset building strategies for low- and moderate-income individuals and families. They offer:

- Research and analysis: Studies and reports on the role of assets, such as homeownership and savings, in building wealth and economic stability.

- Policy development and advocacy: Working to create policies that promote asset building and address economic inequality.

- Technical assistance: Providing training and resources to organizations working to help low-income families build assets.

D. National Urban League: https://nul.org/

The National Urban League is a historic civil rights organization that works to empower Black communities and promote economic equality. They offer:

- Economic empowerment programs: Job training, financial literacy education, and entrepreneurship support services.

- Policy advocacy: Working to address racial discrimination in housing, education, and employment.

- Community development initiatives: Investing in Black communities to create jobs, improve access to education and healthcare, and promote economic development.

These are just a few examples of the many resources available to individuals, communities, and policymakers working to bridge the wealth gap and create a more equitable economic landscape for all Americans. By utilizing these resources and working together, we can collectively create a future where the wealth gap is a thing of the past and all Americans have the opportunity to thrive.

Building a Brighter Future: A Journey, not a Sprint

Bridging the wealth gap and achieving financial security for Black Americans is a long-term endeavor. It requires sustained commitment, consistent action, and a willingness to seek support and utilize available resources. While the journey may be long, every step taken brings us closer to a brighter future for Black communities and the nation as a whole.

Black Americans: Both Black men and women hold significantly less wealth than their White counterparts. Black women hold the lowest median wealth, highlighting the intersectional inequalities faced by this group. White Americans: White men hold the highest median wealth, followed by White women. However, a gender wealth gap still exists within this group. Hispanic Americans: Hispanic men and women also face considerable wealth disadvantages compared to White Americans. Asian Americans: While Asian men hold the second-highest median wealth, Asian women experience a significant gender wealth gap within their group.

Remember, building wealth is a marathon, not a sprint. There will be challenges and setbacks along the way, but with perseverance and a focus on long-term goals, individuals and communities can overcome these obstacles and achieve financial success.

Here are some key takeaways to remember:

- Knowledge is power: Equip yourself with financial literacy and learn about wealth-building strategies.

- Seek support and build community: Connect with mentors, join financial support groups, and collaborate with others.

- Utilize available resources: Take advantage of financial education programs, access government assistance programs, and consider seeking professional financial advice.

- Advocate for change: Support policies that promote economic justice and address racial discrimination.

By taking these steps and working together, we can create a society where Black Americans have the tools and opportunities they need to build wealth, achieve financial security, and contribute to the economic prosperity of our nation.